Banking reform, is it working? Are we witnessing similar  issues as existed in the fourth and fifth century AD? We have all learned the history. Is it similar? We have a CEO compensation equity issue similar to the health industry.

issues as existed in the fourth and fifth century AD? We have all learned the history. Is it similar? We have a CEO compensation equity issue similar to the health industry.

Is this only the tip of the iceberg?

What is reasonable?

What is right?

Is that for us to decide?

Are we stockholders once removed?

Here are some of the staggering incomes:

- Wells Fargo CEO; 21.3 Million

- J.P. Morgan CEO; 15.5 Million

- Bank of NY Mellon CEO; 14 Million

- Bank of America CEO; 4.2 Million

- Capital One CEO; 6.1 Million

- American Express CEO; 17.4 Million

- CNA Financial CEO; 10.4 Million

- Mastercard CEO; 10.3 Million

- Visa CEO; 13.7 Million

The fact is that these people earn more in an hour than many of their employees make in a year. The same holds true for Walmart, Yahoo, Johnson & Johnson, Phillip Morris, AT&T, CVS, HP, Exxon, Abbott Labs, Travelers, Lincare, Prudential, Brystol-Myers, Aetna, Hess, McDonalds, American Express, Coca-Cola, Heinz and Dow Chemical. More in an hour than many employees make in a year. See here for more CEO’s that fit into this category.

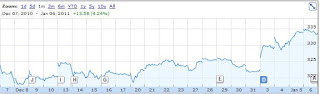

Is there a silver lining? What does it mean that Eric Schmidt, CEO of Google earned $245,322 in 2009. Does Eric have a new vision? Eric?

Here is an interesting read: http://www.roman-empire-america-now.com/